The Finance Linked Individual Subsidy Programme (FLISP) was revised in 2012 and later updated in 2018. This programme is a South African government initiative for households in the ‘gap’ market—those who are too rich to qualify for the RDP subsidy but too poor to easily afford a new house. FLISP is intended to assist these households to access housing, by providing a subsidy that can be used to pay the deposit on a house or to decrease the size of the home loan.

To date, CAHF has published three blogs on the FLISP: wondering whether FLISP would be successful, trying to understand how it would work and celebrating its expansion to the resale market. These blogs, and the two documents on our website (the FLISP policy from 2012, and subsidy value tables from 2018), received an incredible response—hundreds of individuals asked questions through the comment section of our website, and dozens called and emailed. This response shows that there is a clear demand for more information about FLISP. This blog contains the most recent information we have, and will hopefully provide the answers that many are looking for:

Do I Qualify?

Government has set a number of criteria that you have to meet in order to qualify for FLISP:

Income: Your household must earn more than R3 500 but less than R22 000 a month. This is your household’s income (both you and your spouse’s income, or any relative you apply for a home loan with). It refers to your gross salary–the total amount you receive before taking away taxes or deductions.

Dependents: You must be living with a partner (either married or habitually cohabiting) or living with financial dependents. Financial dependents include: children, grandchildren, parents, grandparents, sisters or brothers under 18, and unwell extended family members.

A house to buy: You need to find a house to buy (either a new house or an existing house), and the seller needs to have a title deed. This house can cost any amount that you can afford (previously the maximum property value for the house was set at R300 000 but that cap was removed in 2014). This Programme may be used to acquire any formal residential property (including previously housing subsidy financed properties) on condition that the households have successfully applied for mortgage loans to finance the purchase.

The house can part of a new housing development: some developers already have deals with National Housing Finance Corporation (NHFC), which makes it easier to access FLISP–you can contact the NHFC for more information. Or you can use the FLISP to purchase a house on the resale market (an old house that is being resold). If you can’t buy a house, FLISP can be used to build a house on a vacant stand that you already own.

Previously, FLISP beneficiaries were not allowed to sell their houses until 8 years after they had purchased their house. However in 2018 a decision was taken to remove this sales restriction.

Home loan: You need to have applied for home loan (also known as a mortgage) to qualify for FLISP. It can be done through a bank or through a company that offers home loans (such as SA Home Loans). You can also apply for a building loan to build a house on a vacant plot. To get the loan, most banks will want you to show proof of two years of continuous, formal employment for you to qualify for the loan, and will want you to have a good credit record.

In 2018 government took a decision to expand the scope of the programme to permit beneficiaries to use non-mortgage options to purchase their home, such as pension/provident fund-back loans, short-term loans or savings-linked schemes. However the details of how this would work have not yet been determined, so that option is not yet available in practice.

Never owned a home: The house that you intend to purchase has to be your first house. If you have previously owned a property and had a property registered under your name, you will not qualify for FLISP. This applies to you and the person you apply for the loan with (whether your partner or a family member, and includes the family member’s partner).

Never received government assistance for housing: According to law, you may only receive government assistance for housing once. For example, if you have already received an RDP house from government, then you would not qualify for FLISP. This is both for you and the person you apply for the loan with (whether your partner or a family member, and includes the family member’s partner).

However, the recent changes that were made to the FLISP programme in 2018 have aligned the programme with the Government Employees Housing Subsidy Scheme (GEHS). Public servants who receive housing assistance through the GEHS will in future still qualify for a FLISP subsidy. Public servants must enroll with the National GEHS Administrator under the GEHS to qualify for FLISP.

Resident of South Africa: You must either be a South African citizen or have permanent residency.

How do I apply for FLISP?

If you are purchasing new house as part of a FLISP housing development project, then the developer assists you to complete the FLISP application form and submits it for you to the NHFC. If you are buying an existing house in the open market, once the bank grants you approval for a home loan, then you complete the FLISP application form (with the assistance of the estate agent) which you can access on the NHFC website, or at the provincial department of human settlements office, or the municipal office. the form is submitted to the NHFC. There is more information on how the process works on the NHFC website here.

What subsidy amount do I qualify for?

This depends on your household income; it will be between R27 960 and R121 626. The less you earn, the more subsidy you qualify for. The subsidy for those earning R15 000 a month has increased to R62 304 (it used to be R20,000), up to R121 626 if you earn R3 501 a month. Take a look at the FLISP Subsidy tables to see exactly how much you would qualify for.

How does FLISP work?

The main principle behind the FLISP is that it has to be tied to a home loan. You cannot get the FLISP without a home loan. Then, FLISP is meant to work in one of two ways:

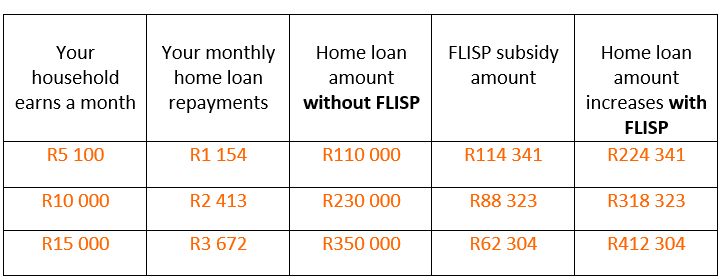

- FLISP can be used to decrease your loan amount, which decreases your monthly repayments. For example, if the house you want to buy costs R250 000 and you qualify for a subsidy of R88 323, your monthly repayments will be R1 696 less than without FLISP. Here are some examples of how this works, if you are paying back a loan at 11.25% (1.00% above prime of 10.25%) over a period of 20 years (which may vary from bank to bank):

Almost every home loan requires a deposit. Sometimes the deposit is bigger than you can afford. FLISP can be used to pay the deposit needed by the bank.

What house can I afford?

A tricky question to answer because only a bank can inform you of the size of the loan you can qualify for. When applying for a loan, according to the National Credit Act, you have to undergo an affordability and credit assessment before you can be approved. This assessment considers your and your partners’ net income, your credit record, your existing debt, and your monthly expenses, among other things.

We believe that you should spend no more than 25 – 30% of your monthly gross income on housing. But this can be bigger or smaller depending on your expenses, savings and debt.

What are the alternatives to buying a house?

FLISP also allows for you to apply for a serviced stand. This stand will be free, but receiving it means you cannot get any further assistance from government. Once you receive the stand, it will be up to you to build on it. However, most municipalities or provincial offices have not implemented this but it is part of the FLISP policy. You will need to check what is possible in your area by contacting your municipality or your Provincial Departments of Human Settlements.

If you already own vacant land, you can get a home loan to pay a NHBRC-registered builder to build a house. The FLISP would then work the same way as if you were buying a house, but the builder should help you apply for FLISP.

Many people asked if they can receive the land and then use the subsidy to construct a home. This isn’t possible—you qualify either for the subsidy (for a home loan to buy a house or build one) or the free, serviced vacant plot, but not both.

If you earn less than R3 500 per month and meet other criteria, you could qualify for an RDP house. This house is free and provided by the government. Contact your provincial department of human settlements for more information.

What should I do if I apply for FLISP but haven’t received a response? What should I do if I was awarded a FLISP subsidy but I haven’t received the funds?

If you have not received a response, you can contact the NHFC to assist you. Another common problem was that many people were awarded the subsidy but do not follow up to receive the funds (once the transfer has gone through). If these problems apply to you, first contact Mathews Sidu (email: mathewss@nhfc.co.za | contact number: 011 644 9800). If you cannot get hold of Mr. Sidu, contact Oupa Mareletse (email: oupam@nhfc.co.za | contact number: 011 644 9800).

What else do I need know about FLISP?

If the house is bought with a partner or family member, then you must make sure that the house is registered under both of your names.

There were many questions whether being black-listed would disqualify a FLISP application. Being black-listed does not, but it does affect your chances of qualifying for a home loan—a bank will not give you a loan if you are black-listed or over-indebted. We advise you to pay off your debt and clear your blacklisting before you apply for a home loan. The National Credit Regulator (NCR) can give you advice if you are in debt or are black-listed. You can contact the NCR for more information.

It is important that the seller of house you buy has a title deed for the property that is registered with the Deeds Office. When you buy the house you must make sure you transfer it to your name. You cannot get the FLISP, or a home loan, if you do not follow the formal process of transferring the property into your name. For this you will need a special lawyer, known as a conveyancer. You can contact the Estate Agency Affairs Board for more information about this.

A problem could be that you do not get a FLISP subsidy because there is not enough funding for the programme. Each year each provincial departments of human settlements set aside money for FLISP. There is the chance that a provincial departments of human settlements do not set aside enough funding for all the FLISP applications for the financial year. If you fail in your application for FLISP because of this, try applying after April of the next year, when there is a new budget for FLISP.

NHFC application form: http://www.nhfc.co.za/images/pdf/FLISP-Application-Form.pdf

NHFC has its own frequently asked questions (FAQs) section on its website: http://www.nhfc.co.za/FLISP/faq.html

Contact Details:

Contact Details:

National Housing Finance Corporation (NHFC)

Address: Isle of Houghton, Old Trafford 3, 11 Boundary Road, Houghton

Contact Number: 0860 011 011

Email address: flisp@nhfc.co.za

Website: www.nhfc.co.za

Estate Agency Affairs Board (EAAB)

Contact Number: 087 285 3222

Website: www.eaab.org.za

National Credit Regulator (NCR)

Contact Number: 0860 627 627/011 554 2600

Website: www.ncr.org.za

Provincial Departments of Human Settlements

Eastern Cape

Address: Steve Tshwete House, 31-33 Phillip Frame Road, Waverly Park, Chiselhurst

Contact Number: 043 711 9901/043 711 9902/043 711 9903

Free State

Address: 7th Floor, OR Tambo House, Cnr Markgraaf & St. Andrews Street, Bloemfontein, 9301

Contact Number: 051 405 4400/051 403 3311

Gauteng

Address: Lisbon Building, 9th Floor, 37 Sauer Street, Johannesburg

Contact Number: 011 355 4000

Kwa-Zulu Natal

Address: 203 Church Street, Pietermaritzburg, 3201

Contact Number: 033 392 6400

Mpumalanga

Address: 7 Government Boulevard, Riverside Park Building, No. 6 & 7, Nelspruit

Contact Number: 013 766 6088

North West

Address: 3366 Bressemer Street, Mafikeng

Contact Number: 018 388 2890/018 388 2891/018 388 2892

Northern Cape

Address: JS du Plooy Building, 9 Cecil Sussman Road, Kimberley, 8301

Contact Number: 053 830 9400/053 830 9422

Western Cape

Address: 27 Wale Street, Cape Town

Contact Number: 021 483 6488 / 021 483 0623 / 021 483 0611 / 021 483 8984